stock option tax calculator uk

Exercising your non-qualified stock options triggers a tax. The rate of CGT on the disposal of the shares in the UK can be as low as 10 per cent.

Capital Gains Tax What Is It When Do You Pay It

Stamp Duty Reserve Tax SDRT when you.

. The rate of CGT on the disposal of the shares in the UK can be as low as 10 per cent. Click to follow the link and save it to your Favorites so. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

The 49 best Stock Option Tax Calculator images and discussions of March 2022. Please enter your option information below to see your potential savings. In particular stock trading tax in the UK is more straightforward.

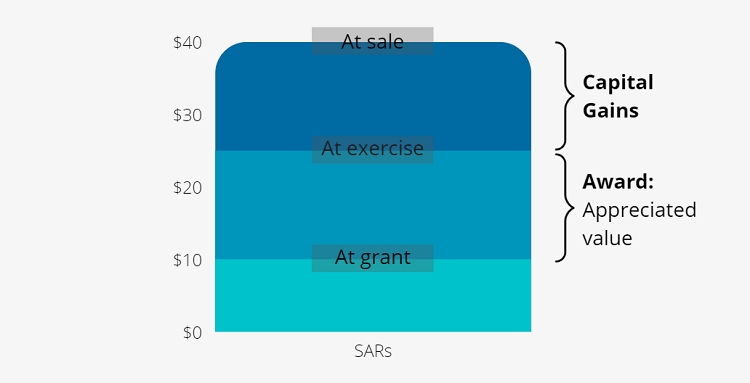

The issue of stock options under an advantageous plan should also mitigate any social security payable by. Lets say you got a grant price of 20 per share but when you exercise your. The 42 best stock option tax.

This online calculator will calculate the exact amount of tax that you owe considering all the factors mentioned above. The Stock Option Plan specifies the total number of shares in the option pool. Income Tax Calculator 2020 21 Calculate Taxes For Fy 2020 21 Income Tax.

Since the spread on an NSO is treated as ordinary. The Stock Option Plan specifies the total number of shares in the option pool. Per IRS Topic 409 if you trade in.

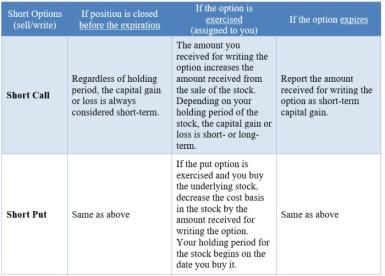

Nonqualified stock options have a pretty straightforward tax calculation eventually well build a calculator for you to use. Section 1256 options are always taxed as follows. 60 of the gain or loss is taxed at the long-term capital tax rates.

XSP Provides Greater Flexibility for Options. Incentive Stock Option Calculator. You can deduct certain costs of buying or selling your shares from your gain.

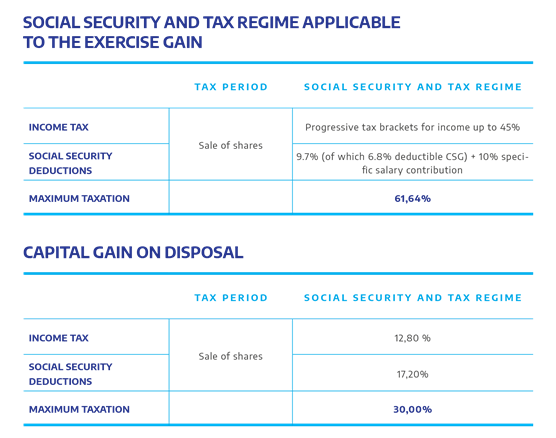

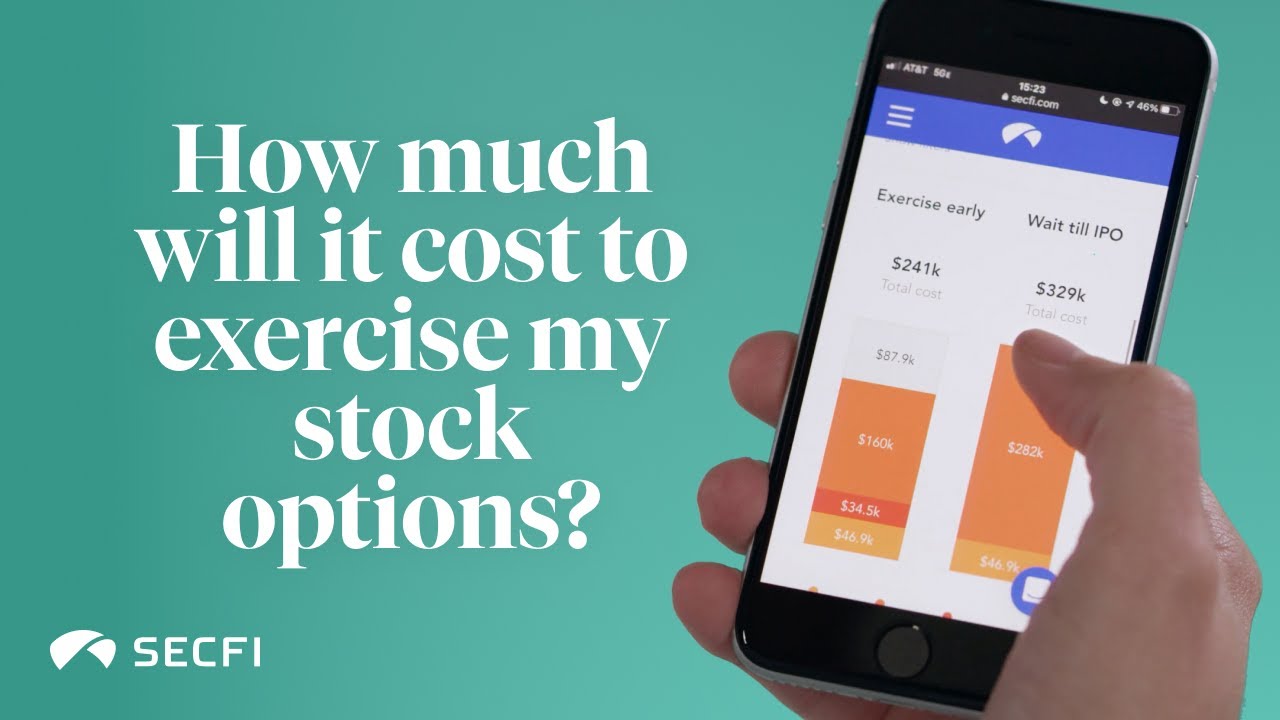

This permalink creates a unique url for this online calculator with your saved information. This calculator illustrates the tax benefits of exercising your stock options before IPO. When the option is exercised the option gain is subject to income tax up to 45 in the uk and 37 in the us.

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. Taxes for Non-Qualified Stock Options. Option Exercise Calculator This calculator illustrates the tax benefits of exercising your stock options before IPO.

Open an Account Now. How Does Stock Tax Calculator Work First of all you provide the. Stock option tax calculator uk Friday May 6 2022 Edit.

The 42 best Stock Option Tax Calculator Uk. Short-term and long-term capital gains tax. Alice now has a tax liability on the 25000 worth of stock which is taxed at the ordinary income rate.

Fees for example stockbrokers fees. How much are your stock options worth. On this page is an Incentive Stock Options or ISO calculator.

The 42 best Stock Option Tax Calculator Uk images and discussions of May 2022.

Best Crypto Tax Software Top Solutions For 2022

How To Calculate Equity Value Equity Ipo Guide Wealthfront

Rsus A Tech Employee S Guide To Restricted Stock Units

Stock Appreciation Rights Sars Vs Stock Options What You Need To Know

How To Selling Stock Options When You Re In The Highest Tax Bracket

Startup Equity Value Calculator By Triplebyte

Taxation Of Stock Options For Employees In Canada Madan Ca

Taxation Of Restricted Stock Units Rsus Carter Backer Winter Llp

5 Best Stock Trading Apps 2022 With Low Fees The Economic Times

How Are Options Taxed Retirement Plan Services

Secfi Stock Option Tax Calculator

Calculating Diluted Earnings Per Share The Motley Fool

Equity 101 How Stock Options Are Taxed Carta

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software

Introducing Buffer S Salary Calculator New Salary Formula

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)